When you think about becoming debt free, it can be overwhelming to imagine all of the questions that come up, like:

- How much debt do I even have?

- How does debt payoff work?

- What order should I pay off my debt?

- Should I pay off debt or invest?

This article will walk you through the answers to each of these questions, to make your path to debt freedom clear and simple.

How much debt do I even have?

The first step to becoming debt free is knowing what you owe. This can be a scary undertaking. Facing the truth about your debt can be rough, but is a necessary step towards paying it off.

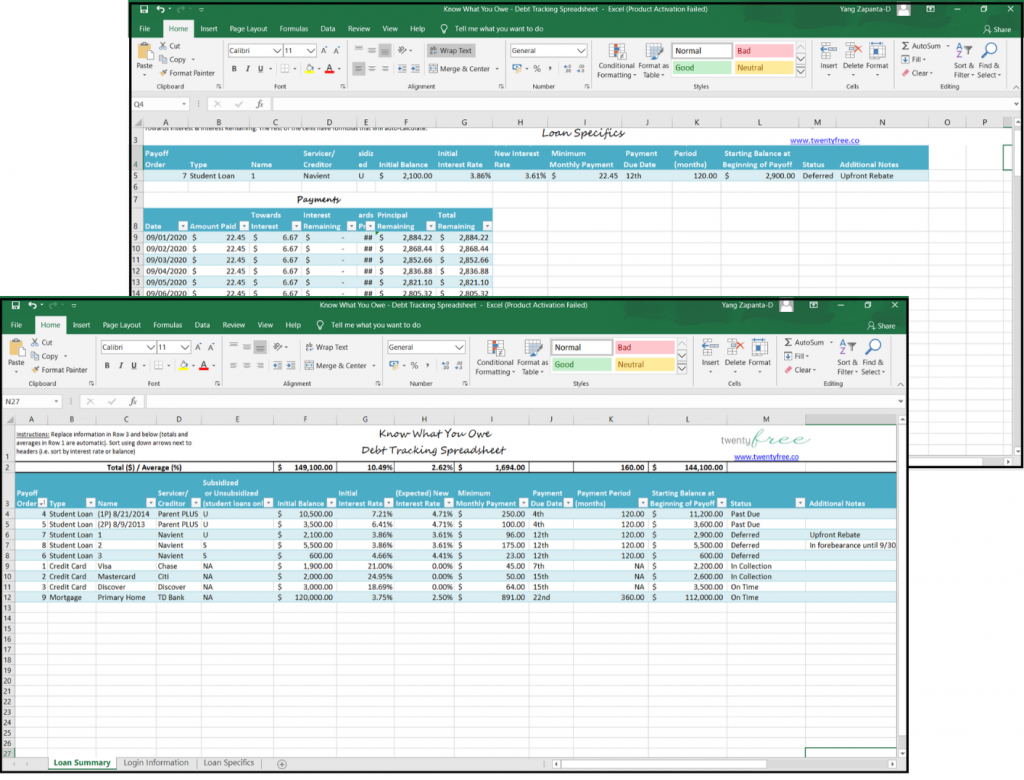

I didn’t even realize that I had six-figures of student loan debt until just before graduation. Then, when I saw the $100,000 balance on my student loans, I knew it was time to face the music. I came up with a “Know What You Owe” spreadsheet that detailed each loan’s type, if it was subsidized or unsubsidized, its initial balance, and its interest rate.

This was relatively easy for me because I only had to go to two places to see my student loan balances. It can be a little harder when you have multiple types of debt, but don’t be discouraged.

Check Your Credit Report

The first place you can look for a list of your debts is on your credit report. There are lots of places to get a free credit report online, like Credit Karma, and while this is good for keeping an eye on your credit, I would recommend that you get an official credit report for this step in your debt freedom journey. To get an official credit report from each of the credit reporting agencies, Equifax, Experian and TransUnion, you can go to AnnualCreditReport.com. A copy of your credit report from each agency is free once a year from this website, and you’ll get the credit report delivered instantly online.

Be aware that if you have debts that were sent to a debt collector, you should determine if they are past the statute of limitations for collection. Those are state laws that say how long collectors are allowed to sue to collect old debts. You can open a can of worms by making a payment on a debt that is outside of the statute of limitations, because it may extend the period in which the collector can sue to collect that debt.

Make a list of the active accounts on your credit report. These might include credit cards, student loans, car loans, or mortgages.

Know What You Owe

When you have multiple types of debt, you’ll want to keep track of what type of debt you have, who the creditor is (meaning who you owe it to), what the balance is, what the interest rate is, and what the payment period is (meaning how many months or years you have to pay it back).

I’ve created a Debt Freedom: Know What You Owe spreadsheet for multiple types of debt that you can download for free.

Once you’ve filled out this spreadsheet with all of your debts, you are going to want to get in touch with the creditors. This can be done most easily online, if you have login information for their website. Be sure to write down all of your login information, or even better, save it in a secure browser extension like LastPass, so that you can login in the future to keep an eye on your balances. When you go in, you will want to find out what the current balance of each of your debts are, what the monthly payment is, and what the due date is.

Then, you’re going to add up the total amount of debt you owe. This might be a shocking number, but it is an important starting place for your debt free journey.

How does debt payoff work?

There are two parts of a debt: the principal, and the interest. The principal is how much you initially borrowed and have to pay back, and the interest is what your lender is charging you to loan you the money.

When you’re paying off debt, the balance will go down. But, keep in mind that the balance won’t go down by the full amount you pay. That’s because part of your payment goes towards paying principal, and part goes towards paying interest, which typically accrues daily or monthly.

For example, if you made a payment of $100 on a $1000 loan, and $50 goes to interest, your loan balance only decreases by $50 every month. That means that your interest the next month will be calculated on the $950 balance, even though you paid $100.

You need to look at your loan statements and see how much each payment actually reduces the amount you owe.

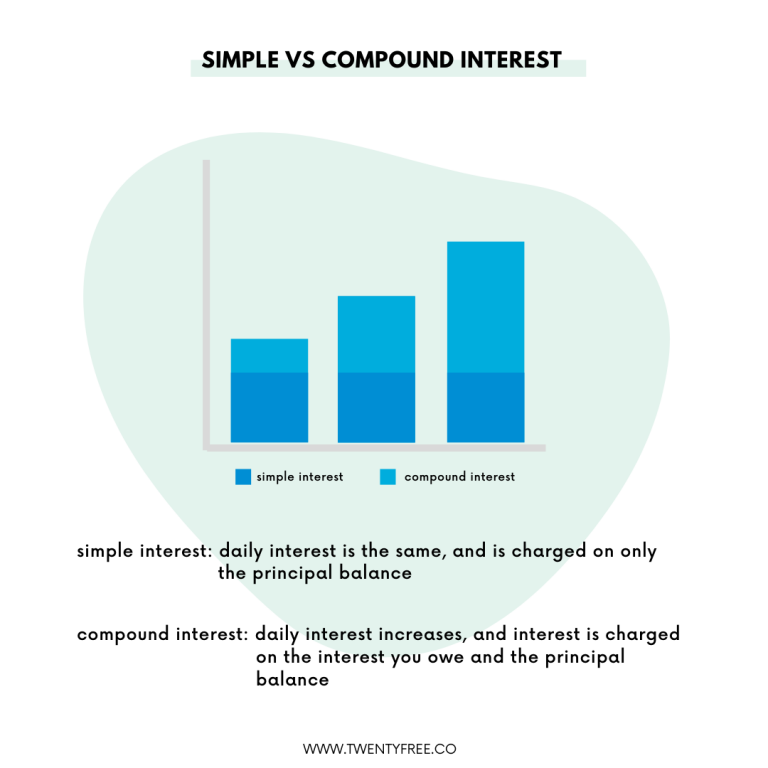

There are two main types of interest: simple and compound interest.

Simple Interest

First, let’s talk about simple interest. Monthly simple interest is calculated by multiplying the daily interest rate, the principal loan balance, and the number of days between payments. This formula only charges interest on the principal, so your daily interest cost will remain the same. If your daily interest cost is $5, and you pay monthly, you will owe $150 in interest each month.

Most mortgages, car loans, and student loans are simple interest.

Now for mortgages, there are more components to your loan than just principal and interest. When you pay your normal monthly payment to a mortgage company, that payment gets split up into principal, interest, homeowners insurance, and taxes. Even if you bought the house in cash and didn’t have a mortgage, you’d be paying insurance and taxes. What this means is that your mortgage loan balance will not decrease by the full amount that you pay each month. So the insurance and taxes are taken out of your payment, and what’s left is first applied to your interest. Whatever is left after that is applied to your principal.

Compound Interest

Now let’s talk about compound interest. Just like compounding can be a good thing when you’re making money in the stock market on money you’ve previously made, it can be a bad thing when it comes to interest on debts you owe. With compound interest loans, you are paying interest ON your interest. That means, your daily interest rate is multiplied by the principal loan balance PLUS any unpaid interest up to that point. If your loan compounds interest on a daily basis, unpaid interest is added to your principal every day. For example, if you have a $10,000 loan and your initial daily interest is $5, each day your interest is added to the principal. So the next day, you’re charged interest on a principal balance $10,005. This means that the interest you pay daily will increase.

Credit card issuers typically charge compound interest that compounds daily.

Additionally, there are some instances in which student loans can experience compound interest. This is usually when something called capitalization occurs, which combines the outstanding interest balance with the principal balance to create a new principal balance. Then going forward, you are charged interest on this new, higher principal balance. For federal student loans, your unpaid interest may capitalize at the end of your separation or grace period, forebearance, or deferment.

Now that you understand how interest works, there’s good news! Extra payments that reduce your principal lower each subsequent interest payment, saving you money over the life of the loan.

Reducing Your Minimum Payments

Before we start talking about making extra payments, you need to make sure you can pay the minimum payments for all of your debts. If you can’t afford your minimum payments, talk to your loan servicer to discuss options like deferment, forbearance, or a payment plan. Additionally, you can lower your minimum payments on federal student loans by applying for income based repayment plans, which will change your minimum payment based on your income.

Refinance Your Loan

You could also decrease your interest rates in a variety of ways. Refinancing your debt to lower the interest rate (and therefore lower the minimum payment) is a good option, especially if your credit score has increased since you took out the loan. Refinancing a debt is something to consider even if you can cover the minimums, because a lower interest rate will allow you to pay off your debt faster and pay less interest overall.

Refinancing is when you replace an existing loan with a new one, which pays off the debt of the old loan. The new loan should have better terms for this to make sense, such as a lower interest rate or a fixed interest rate rather than a variable interest rate. Other terms of the loan can be changed as well, which we won’t get into here, but be sure to do your research before refinancing any loans.

Be aware that there are downsides to refinancing that include transaction costs or loss of benefits. For example, you will often pay 3 to 6% of the loan balance to refinance, and refinancing or consolidating federal student loans to a private loan means that you are no longer eligible for benefits such as deferment, forbearance, or loan forgiveness. If you’re looking to refinance your student loans or take out a personal loan, I recommend checking out SoFi. If you use this link, you’ll get a $300 welcome bonus if you choose to refinance with SoFi. Please do your research and understand the new terms before refinancing any loans.

Decrease Your Interest Rate

There are other ways to decrease interest rates as well. For student loans, you can get auto-debit discounts for signing up to have your loan servicer automatically pull your payment from your bank account. There are also upfront rebates which are offered when you first take out the loan, and then they’re given back to you once you make a certain amount of on-time minimum payments towards the loan during the repayment period. For credit cards, you can transfer your balance to a promotional 0% interest rate credit card. Be aware that there can be fees for this, and make sure to keep an eye on when the interest rate on the credit card increases from 0%.

Save and Earn More Money

Besides negotiating with your lenders or lowering your interest rates, other ways to free up money to make your minimum monthly payments is to cut your spending or increase your income. When it comes to cutting spending, be sure you are treating your minimum debt payments as required expenses, and that you are paying them before spending money on discretionary purchases. To increase your income, you could ask for a raise, change jobs, or start a side hustle.

Once you have all of your minimum payments covered, you can decide which debt to put additional payments towards in order to pay it off completely.

What debt should you pay off first?

In order to save the most money and reduce your financial stress, it makes sense to address the riskiest and highest interest debts first. Generally, I recommend that you pay off debts from Worst to Best as ranked in this blog post. In summary, that means starting with credit card debt, then car debt, then student loans, then mortgage or business loans.

Avalanche Method

Credit card debt is usually a good first choice, because the interest rates are typically the highest and the interest compounds daily. By paying off this debt, you are freeing up significant cash flow that can then be used to pay off your remaining debts. You’re also saving the most money (in terms of interest that would be paid) by tackling this first.

Paying off debts with the highest interest rate first is called the Avalanche Method. This is the most mathematically efficient way to pay off debt quickly while paying the least interest.

Snowball Method

However, humans aren’t purely mathematical or rational creatures. So sometimes we need to have consistent small wins, instead of waiting for one “big win” at the end, to stay motivated through the debt payoff journey.

That’s where the Snowball Method comes in. Using this strategy, you pay off the loans with the smallest balances first, to gain some quick wins. That will eliminate the number of debts you have, but won’t save you the most money in the long run. However, sticking with the debt payoff journey in the long run is really what matters, so you need to pick the method that you know will be the most psychologically rewarding to you personally.

Additionally, the Snowball Method can be used when you have debts with the same or similar interest rates, so you can save the most on interest while also eliminating the number of debts you have.

Avoid More Debt

Besides figuring out what method you want to follow to pay off your debts, it is also important to avoid future debt.

For credit cards, find a method that works for you – maybe it’s cutting up all your cards, or freezing them in a block of ice, or a shopping ban, or using the cash envelope system. Whatever works, just make sure you’re not adding to the credit card balances that you’re trying to pay off!

For cars and homes, you can actually sell them to downsize or downgrade. This will help you pay off your existing debt and keep you from getting new debt. Then promise yourself that you will keep the current car and home that you have until you are debt free.

Should I pay off debt or invest?

Frequently, I see this question posed as an either/or, making it seem like paying off debt and investing are mutually exclusive. The good news is that they can be done at the same time.

Don’t Leave Money on the Table

I would recommend investing even a tiny amount while you’re paying off debt to get more comfortable with it, and to make sure you’re not leaving money on the table. Frequently, employers will offer a matching contribution to your workplace 401k or 403(b). Since that contribution is a part of your compensation for working at your job, you’re essentially leaving money on the table if you don’t contribute enough to your 401k or 403(b) to earn the match. Typically companies will match something like 3% to 6% of your salary when you contribute it to your 401k or 403(b). That’s not much so it won’t have a huge impact on your debt payoff abilities, but it will get you started investing early so that your investments can compound and grow, and you can build an investment habit.

Compare Your ROI

After contributing enough to get your employer match, you will have to make decisions based on your unique situation. Typically, this will be based on the interest rates of your loans. If you think about it, an interest rate on a debt is the return on investment, or ROI, you can expect when paying off the debt. Better yet, it is a guaranteed return, unlike stock market returns which can vary. The average stock market return is around 10%, before inflation. Since inflation reduces the buying-power of your dollars every year by around 2 to 3%, an inflation adjusted average stock market return is around 7%.

Since investments should be made for the long term, it is OK to use an average return for these calculations, even though we know that the stock market might have negative returns in one year, and double digit returns in another year. By getting your money into the market, and not trying to time the market, you are setting yourself up in a great spot to benefit from compound returns over time and average stock market returns.

Additional Considerations

Another consideration is how long you have to save for retirement, and how long it will take you to become debt free. If you have enough debt that it will take you 5 or more years to pay off, it makes sense to invest while paying off debt. If you are close to retirement age, it would also make sense to invest while paying off debt. If you’re young, in your 20s to 30s, and your debt will take less than 5 years to pay off, you might want to pay off your debt first, then invest with the cash flow that you’ve freed up.

Another thing to keep in mind is that your tax-advantaged investment account options have limits each year. So even if you don’t contribute to, say, your IRA for 2 years while you are paying off debt, you will not be able to make catch up contributions to that tax advantaged account. Once you’re ready to invest, you will be limited by the annual contribution limits.

Strategy for Balancing Paying Off Debt & Investing

Since the inflation adjusted average stock market return is around 7%, we could say the ROI of investing in stocks is 7%. The ROI of paying off your debt is whatever the debt interest rate is. Therefore, you should prioritize paying off debt that is higher than your expected return in the stock market, so in this case, debts that are at a 7% interest rate or higher.

Once those debts are paid off, you can use your freed up cash flow to invest, because now investing will be the same or higher ROI as paying off debt. Consider investing until you hit the limits on all of your tax advantaged accounts, such as 401ks, 403bs, IRAs, and HSAs.

Then you have the option to invest in taxable investments or pay off more debt. You will have to figure your personal tax implications of investing in taxable accounts. I would be inclined to say that once you max out your tax advantaged accounts, you could use additional money to pay off debts, even if they have lower interest rates, in order to reduce stress and create more freedom. But this is going to depend on your personal financial and lifestyle goals.

Case Study: My Own Student Loans

I’ll share what I decided to do in order to pay off most of my $100,000 of debt without waiting to start investing. 5 years ago, I was 21 and I realized I had $100,000 of student loans. Right then, I decided I wanted to become financially independent. First, I made sure to get my 401k match, which required me to put 3% of my salary into my 401k.

Avalanche Method

In order to save the most money on interest, I decided to pay off my high interest loans first. This was the avalanche method, that would end up saving me the most money on interest in the long run. These loans, with an initial balance of $62,000, had interest rates of 6.41 to 7.9%. The remaining loans with an initial balance of $23,000 had low interest rates in the range of 3.40% to 4.66%. Paying off loans with interest rates between 6.4% and 7.9% gave me a similar, if not better, ROI than investing that money in the stock market, so I aggressively paid off those high-interest loans. Therefore, my net worth was affected equally (in a positive way) by paying off the student loans as it would have been by investing. On top of that, I got the freedom and peace of mind that came with paying off the majority of my debt!

Save & Earn More to Make Additional Payments

I funneled my savings into paying off debt, I kept my expenses as low as possible, and besides my 401k match, I did not invest. I made large and frequent principal payments on top of my minimum payments, sometimes $2,500 or more each month. To earn extra money, I worked a part-time job in addition to my full-time job, I negotiated a raise, I funneled my holiday bonuses to my debt, and I worked lots of overtime. All in all, I paid off a total of $67,000 of student loan principal and interest in 1 year and 8 months, including both my minimum payments and additional payments. This accelerated timeline saved me $24,000 in interest!

Take Cash Flow and Invest

Once I finished paying off my high interest student loans, I took the $2,500 each month that was going towards additional debt payments, and used it to reach my investing goals. I was still paying the minimum payment on my low interest student loans, but I no longer had to pay the minimum on the high interest student loans, so that was an additional $600 a month that I could invest. I decided to invest instead of continuing to pay down my student loans because average stock market returns are about double that of my student loan interest rates. Starting in 2018, I started maxing out my tax advantaged accounts including my 401k, IRA and HSA.

The Outcome

5 years after I started paying off my debt, I reached my F-you money goal of $100,000 in assets in November 2019, I was able to quit my job to start a business in January 2020, and I reached CoastFI in February 2020. While I still have some low-interest student loans left to pay off, using a hybrid approach to investing and paying off my student loans simultaneously allowed me to prepare for retirement, create enough financial independence to become self-employed, and reduce my significant stress around my debt.

Conclusion

That’s my story. You get to decide what debt payoff plan would work best for you. This guide to debt payoff should help you figure out how much debt you have, how debt payoff works, what order to pay off your debts in, and whether you should pay off debt or invest (or both).

Your Turn:

What is your plan to payoff your debt? Comment below!

Related Content

Article

- Millenials in Debt: Ignore Outdated Advice and Become Debt Free

- I Just Paid off $67,000 of High Interest Student Loans in Less than 2 Years – and Saved $23,600 in Interest!

Podcast

[fusebox_track_player url=”https://dts.podtrac.com/redirect.mp3/traffic.libsyn.com/secure/findyourfreedom/023-3.mp3″ twitter_username=”fyf_podcast” ]

[fusebox_track_player url=”https://dts.podtrac.com/redirect.mp3/traffic.libsyn.com/secure/findyourfreedom/25-320debt20payoff.mp3″ twitter_username=”fyf_podcast” ]

[…] Ultimate Guide to Paying Off Debt […]

[…] Ultimate Guide to Paying Off Debt […]

[…] Ultimate Guide to Paying Off Debt […]

[…] decreasing liabilities, you will see your net worth increase. You can do this by paying off debt or selling liabilities (if they have value) to pay off debt and remove monthly payments. Another […]

[…] can be hard to decide whether to pay off debt or invest, or to do both at […]

[…] are a few different ways to pay off your debt, including using a debt snowball or attacking your highest-interest debts […]

[…] You can also try some of the following methods for paying off debts: […]

[…] Paying off debt […]

[…] smart with how you pay off debt. Frequently, people delay investing entirely so they can tackle their debt first. However, it can […]

[…] smart with how you pay off debt. Frequently, people delay investing entirely so they can tackle their debt first. However, it can […]

[…] smart with how you pay off debt. Frequently, people delay investing entirely so they can tackle their debt first. However, it can […]

[…] smart with how you pay off debt. Frequently, people delay investing entirely so they can tackle their debt first. However, it can […]

[…] smart with how you pay off debt. Frequently, people delay investing entirely so they can tackle their debt first. However, it can […]

[…] smart with how you pay off debt. Frequently, people delay investing entirely so they can tackle their debt first. However, it can […]

[…] smart with how you pay off debt. Frequently, people delay investing entirely so they can tackle their debt first. However, it can […]

[…] smart with how you pay off debt. Frequently, people delay investing entirely so they can tackle their debt first. However, it can […]

[…] smart with how you pay off debt. Frequently, people delay investing entirely so they can tackle their debt first. However, it can […]